US national debt exceeds $32 trillion for first time

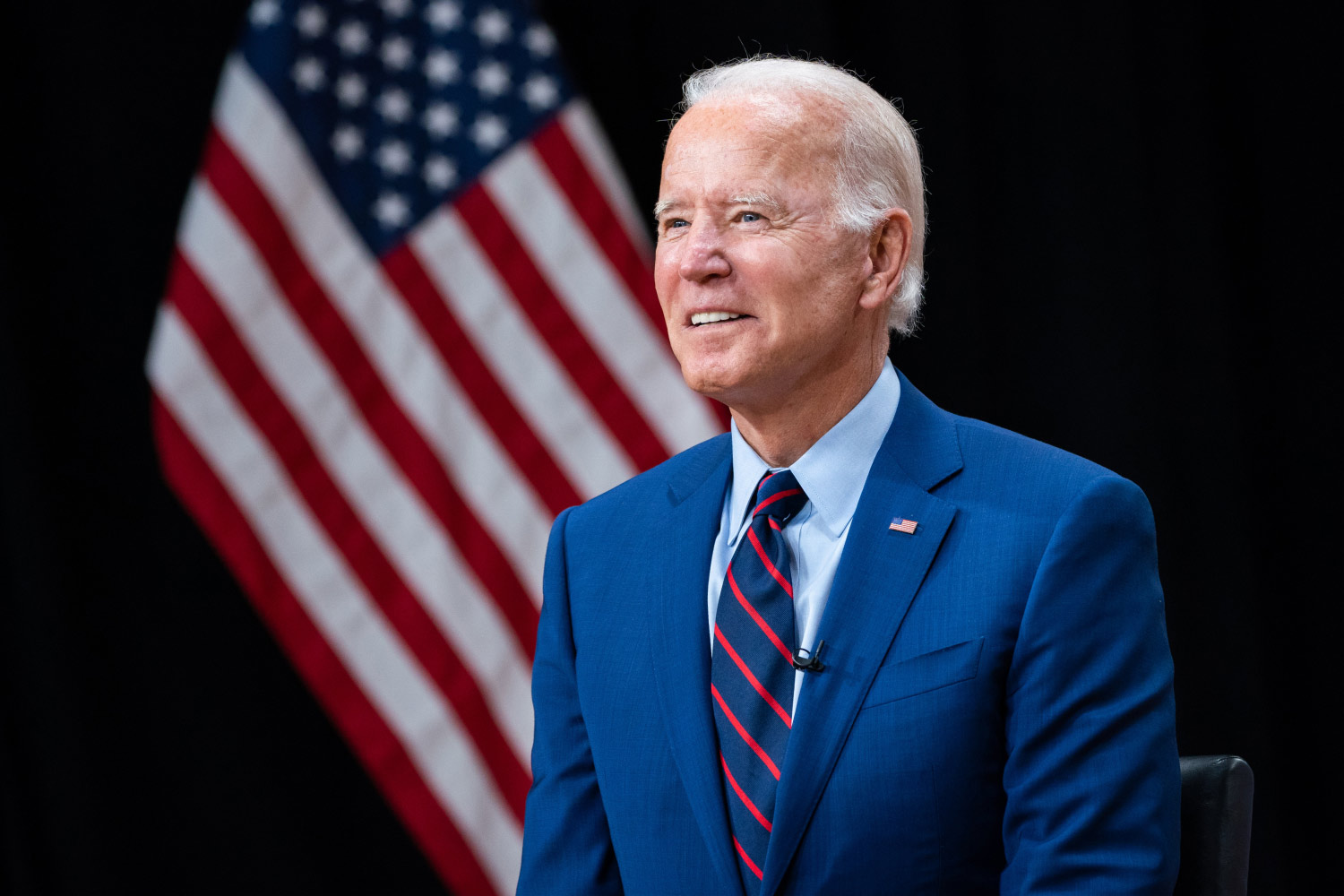

The US national debt has reached a record high of $32 trillion. This milestone comes just two weeks after President Biden signed legislation to suspend the nation’s borrowing limit through the end of 2024.

Despite White House and negotiators for House Speaker Kevin McCarthy (R-Calif.) recent efforts to reduce the debt by agreeing to $1.5 trillion in spending cuts over the next decade, it is still projected to exceed $50 trillion by 2033. This is a serious problem, as it could lead to higher interest rates, inflation, and a decline in the value of the dollar.

“We were fortunate to avoid a default under the debt ceiling, but the broader problem is that we keep ignoring the growing debt itself,” Michael A. Peterson, CEO of the Peter G. Peterson Foundation, a nonprofit focused on fiscal issues, said in a statement Friday.

“As we race past $32 trillion with no end in sight, it’s well past time to address the fundamental drivers of our debt, which are mandatory spending growth and the lack of sufficient revenues to fund it,” Peterson argued.

There are a number of factors that have contributed to the growing national debt. These include the COVID-19 pandemic, which led to trillions of dollars in emergency spending, and the Federal Reserve’s decision to raise interest rates in an effort to combat inflation.

The Peter G. Peterson Foundation, a nonprofit focused on fiscal issues, has warned that the US is on a path to add $127 trillion to the debt over the next 30 years. If this happens, nearly 40% of all federal revenues will be spent on interest payments alone.

Also Read: US bans Ugandan officials after anti-LGBTQI law

The Peterson Foundation recommends establishing a bipartisan fiscal commission to look at all parts of the budget for cuts. This is a necessary step to address the growing national debt and ensure the long-term health of the US economy.