70% of Financial Crimes in Nigeria Linked to Banks — EFCC

The Economic and Financial Crimes Commission (EFCC) has disclosed that a significant portion, approximately 70 percent, of financial crimes in Nigeria are linked to the banking sector.

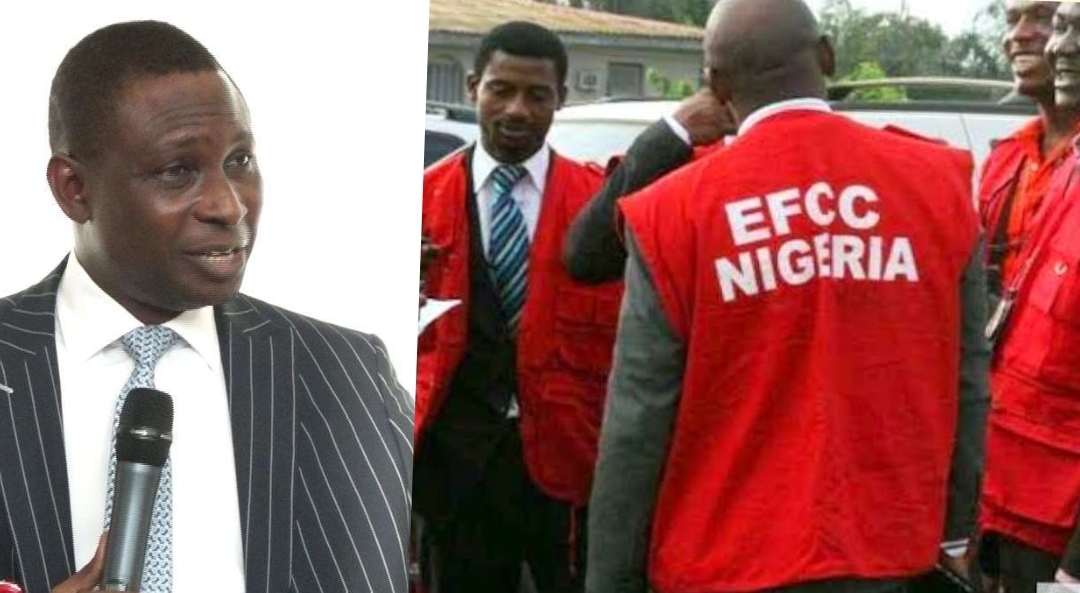

Ola Olukoyede, the Chairman of the EFCC, revealed this during his speech at the 2023 Annual Retreat and General Meeting of the Association of Chief Audit Executives of Banks in Nigeria held in Abuja.

Olukoyede highlighted the growing prevalence of fraudulent activities within the banking industry, which presents substantial challenges and concerns for the commission.

Represented by Idowu Apejoye, the EFCC’s Director of Internal Audit, Olukoyede stressed the necessity for collaborative efforts among relevant authorities and industry professionals, particularly audit executives, to proactively address and combat fraudulent activities within the sector.

He outlined that banking fraud in Nigeria encompasses both internal and external elements. Internal fraud involves activities such as misappropriation of customers’ deposits, unauthorized loan approvals, forgery, and other illicit practices. External fraud includes hacking, ATM fraud, conspiracy, among others. Particularly concerning is the collaboration between insiders and outsiders in perpetrating fraudulent acts.

“Broadly speaking, banking fraud in Nigeria is both inside and outside related. The inside related fraud comprises outright selling of customers’ deposits, authorising loan facilities, forgery and several other kinds of unhealthy and criminal practices.”

Also Read: EFCC arrests 115 BDC Operators, seize over N100m (Photo)

“The outsider related ones include hacking, ATM fraud, conspiracy, among others. And then the absurd one is when both collaborate, that is collaboration among the bankers and the outsider.”

“That one is the one that is really absurd because when you do that, that means you are selling out the system. It is estimated that about 70 percent of financial crimes in Nigeria are traceable to the banking sector, this scenario is disturbing and unacceptable,” he said.