PulseNets Uncovers N1.5 Trillion Discrepancy in Tinubu’s 2025 Budget Proposal

Official Document Confirms N49.7Trillion As Tinubu’s 2025 Budget Proposal, Not N47.96Trillion Presented To National Assembly

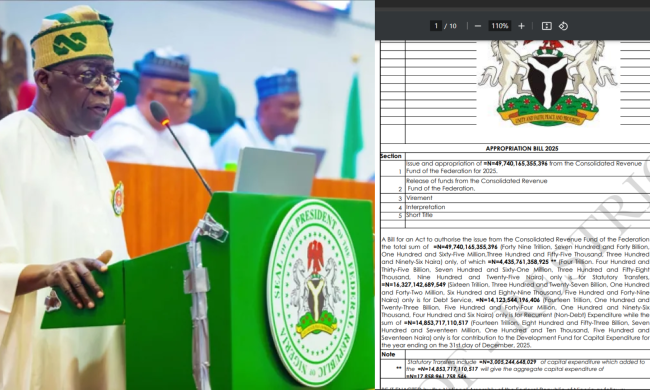

PulseNets’ analysis of the complete 2025 budget proposal document, as presented by President Bola Tinubu before a joint session of the National Assembly—the Senate and the House of Representatives—on Wednesday, has unveiled a discrepancy exceeding N1.5 trillion between the President’s stated figures and those found in the budget document.

President Tinubu informed the National Assembly that the proposed 2025 fiscal appropriation bill stood at N47.90 trillion. However, PulseNets learned from the proposed budget document, which was uploaded on Wednesday, December 18, 2024, by the Budget Office of the Federation, that the actual figure is N49.7 trillion.

During his presentation speech, President Tinubu declared, “Government expenditure in the same year is projected to be 47.90 trillion naira, including 15.81 trillion Naira for debt servicing.”

Further emphasizing fiscal targets, the President stated in paragraph two, “In 2025, we are targeting 34.82 trillion naira in revenue to fund the budget,” and later added in paragraph four, “A total of 13.08 trillion naira, or 3.89 percent of GDP, will make up the budget deficit.”

Details contained within the proposed budget document, as reviewed by PulseNets, outlined, *“A Bill for an Act to authorise the issue from the Consolidated Revenue Fund of the Federation the total sum of =N=49,740,165,355,396 (Forty Nine Trillion, Seven Hundred and Forty Billion, One Hundred and Sixty-Five Million, Three Hundred and Fifty-Five Thousand, Three Hundred and Ninety-Six Naira) only,

“Of which =N=4,435,761,358,925 (Four Trillion, Four Hundred and Thirty-Five Billion, Seven Hundred and Sixty-One Million, Three Hundred and Fifty-Eight Thousand, Nine Hundred and Twenty-Five Naira) only is for Statutory Transfers,

“=N=16,327,142,689,549 (Sixteen Trillion, Three Hundred and Twenty-Seven Billion, One Hundred and Forty-Two Million, Six Hundred and Eighty-Nine Thousand, Five Hundred and Forty-Nine Naira) only is for Debt Service,

“=N=14,123,544,196,406 (Fourteen Trillion, One Hundred and Twenty-Three Billion, Five Hundred and Forty-Four Million, One Hundred and Ninety-Six Thousand, Four Hundred and Six Naira) only is for Recurrent (Non-Debt) Expenditure,

“While the sum of =N=14,853,717,110,517 (Fourteen Trillion, Eight Hundred and Fifty-Three Billion, Seven Hundred and Seventeen Million, One Hundred and Ten Thousand, Five Hundred and Seventeen Naira) only is for contribution to the Development Fund for Capital Expenditure for the year ending on the 31st day of December, 2025.”*

PulseNets also reported that the document noted, “Statutory Transfers include =N=3,005,244,648,029 of capital expenditure which added to the =N=14,853,717,110,517 will give the aggregate capital expenditure of =N=17,858,961,758,546.”

Moreover, the proposed budget document outlined the legislative framework: *“BE IT ENACTED by the National Assembly of the Federal Republic of Nigeria as follows: – (i) The Accountant-General of the Federation shall, when authorised to do so by Warrants signed by the Minister charged with responsibility for finance, pay out of the Consolidated Revenue Fund of the Federation during the year ending on the 31st day of December 2025, the sums specified by the warrants, not exceeding in the aggregate =N=49,740,165,355,396 (Forty Nine Trillion, Seven Hundred and Forty Billion, One Hundred and Sixty-Five Million, Three Hundred and Fifty-Five Thousand, Three Hundred and Ninety-Six Naira) only, for the year ending on the 31st day of December, 2025.

Also Read: Akpabio Finally Reveals Why Tinubu Appointed Wike as Minister

“Issue and appropriation of =N=49,740,165,355,396 from the Consolidated Revenue Fund for 2025.

“The amount mentioned in subsection (1) of this section shall be appropriated to heads of expenditure as indicated in the Schedule to this Bill.

“No part of the amount aforesaid shall be released from the Consolidated Revenue Fund of the Federation after the end of the year mentioned in subsection (1) of this section.”