FG Seeks $1.75bn World Bank Loan Despite Record Revenue Growth

The Federal Government is once again turning to the World Bank for new financing, this time seeking a loan package worth $1.75 billion, PulseNets has learnt, even as officials continue to celebrate what they describe as record-breaking revenue inflows.

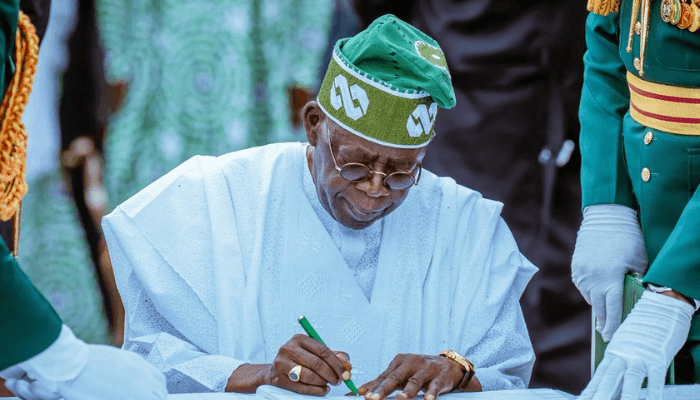

President Bola Tinubu had earlier this week declared that “Nigeria has already surpassed its 2025 revenue targets ahead of schedule.”

Clarifying the president’s statement, the Presidency revealed that the country pulled in ₦20.59 trillion between January and August 2025, a staggering 40.5 percent leap compared to the ₦14.6 trillion earned in the same period of 2024. According to Special Adviser to the President on Information and Strategy, Bayo Onanuga, the surge is being driven primarily by non-oil revenue sources, which now account for 75 percent of total government collections.

Despite what officials hailed as a strong fiscal performance, insiders told PulseNets that Abuja will continue to rely on external borrowing to plug budget gaps and fund strategic projects.

Documents obtained by PulseNets from the World Bank show that the Washington-based lender is preparing to approve the $1.75bn facility before the end of the year. The funds are expected to be channeled into agriculture, healthcare, digital infrastructure, and small business financing.

Among the priority programmes highlighted is the $500 million Nigeria Sustainable Agricultural Value-Chains for Growth project, aimed at boosting farm output and revitalizing rural communities. Also on the list is a $500 million digital infrastructure initiative designed to expand connectivity and accelerate technology-driven growth. In addition, the World Bank is reviewing a $250 million health security programme and another $500 million inclusive finance project targeting micro, small, and medium-sized enterprises (MSMEs).

Sources familiar with the negotiations told PulseNets that these loan applications are currently at different stages of review and approval. The development underscores Nigeria’s sustained dependence on multilateral lenders despite a surge in domestic revenue.

Also Read: FG disburses N135bn of $750m World Bank loan to 36 states, FCT

World Bank records reported by PulseNets show that Nigeria has already obtained $8.4 billion in new credit lines over the past two years alone, a trend that raises questions about long-term debt sustainability even as government revenue performance improves.