States face bankruptcy over N3t subsidy, debts

Prevaling economic realities, especially the rising price of crude oil at the international market, and the cost of petrol subsidy, which is threatening the 36 states could worsen the financial crisis facing the states ahead of 2023 election.

Already the states’ governors have expressed concerns, and are asking the Federal Government to remove subsidies and save states from going bankrupt.

While the Debt Management Office (DMO) put the total domestic debt profile of the states and the FCT at N4.1t, servicing the debt and financing an N9t budget across the states presents a gloomy outlook for the country.

It would be recalled that states only generated about N849.12b Internally Generated Revenue (IGR) in the first six months of 2021. The budget of Lagos State alone for 2022, which stands at about N1.7t, is double the entire IGR. With this development, only a few states may stay afloat with continuous subsidy payments.

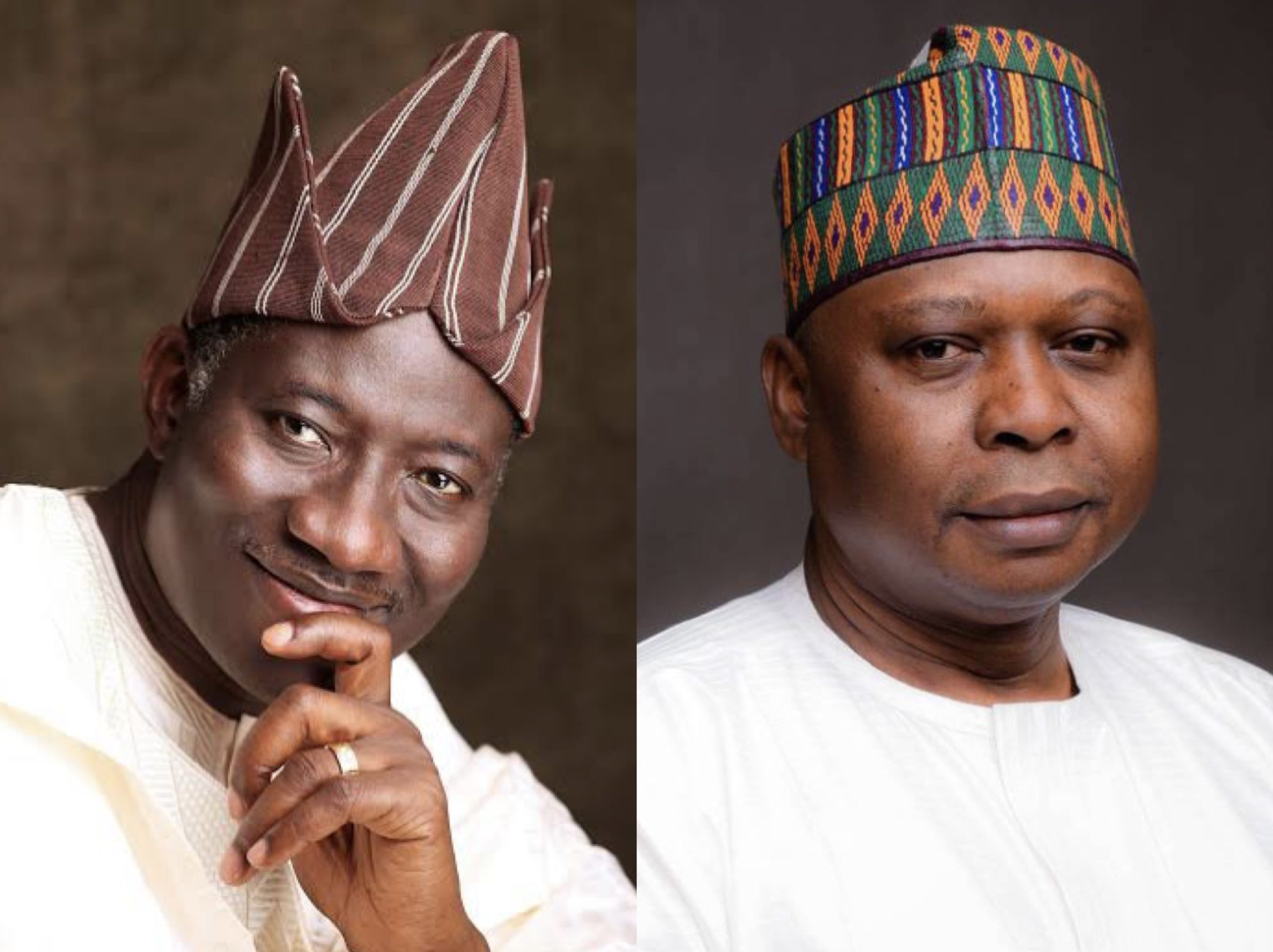

The Chairman of Nigerian Governor’s Forum (NGF) and Governor of Ekiti State, Dr. Kayode Fayemi, had earlier fumed at the profitability status of the Nigerian National Petroleum Company (NNPC) Limited, adding that it contributed nothing to Federation Accounts Allocation Committee, (FAAC) last month.

Even though crude oil currently trades above $110 per barrel (a record high), payment of subsidy has eroded almost 90 per cent of funds expected to accrue to the FAAC. In January 2022 only N20.1b was remitted.

While most states are struggling to survive, with payment of salary already a difficult task, the prevailing economic situation of states is bleak, with over N3t deductions expected from FAAC this year.

“The NNPC contributed zero to FAAC this month. This is not the first time that the NNPC is contributing zero to FAAC. In the last couple of months, we have been having these challenges,” Fayemi said.

According to him, it remains worrisome that an increase in oil price at the international market is creating concerns locally, adding that governors are concerned about how to sustain the sector for a long time.

Calling for a revamp of the oil sector, Fayemi said: “For us as states that are beneficiaries of the goose that lays the golden egg, the oil and gas industry, we also are very desirous that this industry is sustained over the long term. We see areas of concerns, particularly in terms of revitalising the industry around transparency, accountability and governance of the sector.”

His counterpart from Ondo State, Rotimi Akeredolu insisted that the country must find a way to remove subsidy on PMS with immediate effect.

Represented by his Commissioner for Energy, Razaq Obe, Akeredolu said: “Nigeria needs to remove subsidy on PMS now. As Governor Fayemi said, the NNPC brought nothing to the table last month. What that means is that we are running a country that is basically bankrupt.”

In 2022, the states are planning to spend about N9t. Adamawa (N163b), Bauchi (N197b), Borno (N269b), Gombe (N155b), Taraba (N149.7b) and Yobe (N164b). The 2022 budget of Lagos is 1.758t, that of Ogun is N350.7b, Oyo stands at N294.7b, Osun State has a budget of N129.7b, that of Ondo State stands at N199b, while the Ekiti State budget is N100.8b. Kwara State set aside N190b to fund her 2022 budget, Kogi State did N145.8b for the same purpose, and that of Benue State is N155.6b, Niger State’s stands at N211b, the one for Nasarawa State is valued at N114.3b and Plateau State has a budget of N106.8b. While Enugu State’s budget stands at N186.64b, Anambra State is to spend N141.9b, Imo State is spending N381.4b, and it’s neighbour- Abia State has budgeted N147.28b for the spending plan. That of Ebonyi State is N145b, Akwa Ibom budgeted N586.9b for the same year, and Edo State is to spend N222.6b. Neighbouring Delta State is spending N469.5b.

Others are Bayelsa (N314.46b); Cross River (N355b); Rivers (483.1b); Kano (N221b); Kaduna (N278.5b); Katsina (N340.9b); Sokoto, N188b; Zamfara, N159.5b; Kebbi, N189.2b; and Jigawa, N177b.

A former chairman of the Nigerian Electricity Regulatory Commission (NERC), Dr. Sam Amadi, insisted that the poor handling of the nation’s economy under the Muhammadu Buhari-led administration has worsened the plight of the states.

The former governorship aspirant, who described Nigeria as a broken economy because of low productivity and reckless politics, stressed that the APC administration has done a bad job of managing the economy.

“The debt burden, the low productivity and the failure to restructure the federal public service mean that we cannot finance critical projects that would grow the economy and improve livelihoods. In spite of the dwindling revenue, neither the federal or states’ governments are prudent and strategic in public expenditure. Corruption, leakages and sippages are worse than they used to be,” Amadi added.

He pointed out that the present political leadership does not seem to have the competence to stimulate the economy towards productivity.

“We need to have strong economic leadership that can align the states towards productivity; a leadership that can align incentives and enable states to become more prudent and productive. The problem is that we are getting to a presidential election where the struggle for power creates pervasive incentive to waste resources on activities that further weaken production,” he noted.

An economist and an energy scholar at the University of Ibadan, Adeola Adenikinju, stated that with the condition of things in the states, it would be increasingly difficult to meet obligations to civil servants, pensioners and contractors.

Presently, most states are finding it difficult to implement the minimum wage, and Adenikinju added that states, where civil servants drive their economies, would have a greater secondary level effect, as their economies would suffer from limited and uncertain purchasing power.