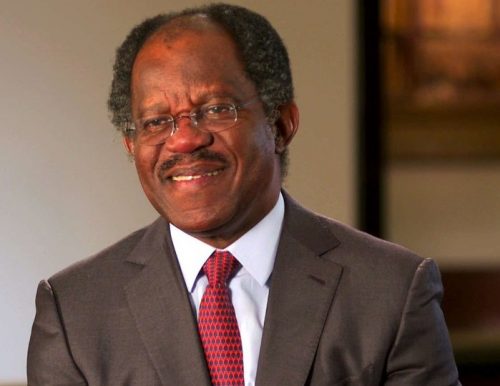

Who is Adebayo Ogunlesi, the Nigerian who charmed BlackRock?

Adebayo Ogunlesi, the banker originally from Nigeria’s Ogun State shook up Wall Street in mid-January by selling his infrastructure investment firm to the American giant for $12.5bn.

Some $106bn in assets under management and a sale at $12.5bn. The two dizzying figures show the scale of the deal made by Nigerian financier Adebayo Ogunlesi.

At 70 years old, the founder and current CEO of Global Infrastructure Partners (GIP) is making a record transaction by selling his investment company to BlackRock, the American behemoth with over $9trn in assets under management, led by Larry Fink.

The deal, unveiled on Friday, 12 January, shook up Wall Street. Coming from an industry leader, this sale confirms the consolidation movement occurring in a sector losing steam, shaken by the rise in borrowing rates.

For Larry Fink, the transaction strengthens the investment offerings made to BlackRock’s clients, particularly in unlisted assets and infrastructure, two areas with tailwinds. But for Adebayo Ogunlesi, known as ‘Bayo’, this 11-figure sale is the crowning achievement of an unblemished career, accomplished almost entirely across the Atlantic.

A Driven Man

Fresh out of King’s College, Lagos, the Nigerian went to Britain in the 1970s, where he earned a bachelor’s degree in philosophy, politics and economics at Oxford University. Then on to the United States for two more degrees at Harvard.

The young man took on prestigious positions from the start of his career, never staying long. The first non-American clerk for a US Supreme Court judge and then a lawyer for the Cravath, Swaine & Moore law firm in New York, Ogunlesi opted in 1983 for the world of banking at Credit Suisse First Boston.

He joined the group as an adviser on a Nigerian gas project and left 20 years later as chief client officer and executive vice chairman. At the start of the second millennium, the Nigerian’s rise was impressive but the banker was already looking for a new challenge.

In 2006, Ogunlesi partnered with five other investment bigwigs – Jonathan Bram, Matt Harris, Michael McGhee, Bill Woodburn and Raj Rao – to launch his own entity: Global Infrastructure Partners.

Based in the heart of New York, the company targeted an asset class that investors at the time had little taste for, preferring investments with quick returns. Ogunlesi’s bet was daring but the results were swift.

After London City Airport, acquired in the first year of business, GIP took over Gatwick, the UK’s second airport in terms of transit, in 2009. The £1.5bn ($1.9bn) deal made an impression and heralded other major takeovers, including Edinburgh Airport in Scotland and Sydney Airport in Australia.

Small African Portfolio

Specialising in transportation, energy, water and waste management, GIP today has stakes in the French company Suez, the company Vantage Towers, with 83,000 telecom towers in Europe, and ADNOC Gas Pipelines, a subsidiary of Emirati hydrocarbon giant ADNOC.

However, in Africa, GIP has a small footprint. The company is indirectly linked to the port of Douala – through its stake in Terminal Investment Limited (TiL), a subsidiary of shipping company MSC.

The billionaire – whose fortune is estimated at $2.3bn if the BlackRock acquisition is confirmed – also sits on the board of Kosmos Energy, developer of the Grand Tortue Ahmeyim gas project, straddling Senegal and Mauritania. But so far, the man who was once Donald Trump’s economic adviser has made few investments on the continent of his birth.

Also Read: Tony Elumelu: Biography, Wife, Children, Foundation, Source of Wealth, and More

With African economies thirsting for infrastructure liquidity, might that change? With an annual financing gap estimated at $100bn, Africa could soon become fertile ground for Adebayo Ogunlesi and his new home, BlackRock.

In March, the American company acquired nearly a third of the shares in Kenya’s Lake Turkana wind farm from the Finnish company Finnfund.