Nigeria Revenue Service Clarifies: No VAT on Money Transfers, Only on Banking Charges

A clarification has been issued by the Nigeria Revenue Service (NRS) following widespread public confusion over claims that Value Added Tax (VAT) has been newly imposed on banking transactions and electronic transfers.

The clarification followed a social media post by Taiwo Oyedele, who shared an explanatory caption alongside an official press statement to address what he described as persistent misinformation. In the post, Oyedele stressed that customers are not being taxed for transferring money.

“There is NO VAT on the money you transfer. VAT is only charged on the banking fee or commission, which has been the case since VAT was introduced in 1993,” he wrote.

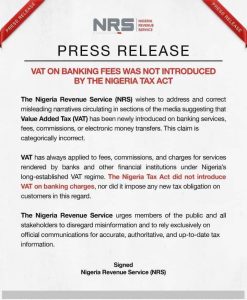

PulseNets learnt that the NRS issued the statement after observing misleading reports in sections of the media suggesting that the Nigeria Tax Act recently introduced VAT on banking services, commissions, or electronic money transfers.

In its official press release titled “VAT on Banking Fees Was Not Introduced by the Nigeria Tax Act,” the revenue authority categorically dismissed the claims, describing them as false and inaccurate.

According to the NRS, VAT has, for decades, been applicable to service-related charges such as banking fees, commissions, and other administrative costs incurred during financial transactions. The agency clarified that this framework has remained unchanged since the introduction of VAT in Nigeria.

The Service further explained that the Nigeria Tax Act did not create any new VAT obligations on bank customers, nor did it extend VAT to the actual sums being transferred between accounts.

PulseNets reported that the NRS urged Nigerians to remain vigilant against misinformation, particularly on tax-related matters that directly affect public confidence in the financial system.

“The Nigeria Tax Act did not introduce VAT on banking charges, nor did it impose any new tax obligation on customers in this regard,” the Service stated in the release.

Also Read: Nigeria Revenue Service New Tax Laws: Full Impact of Reforms to Become Clear from January 1, 2026 — FIRS

The NRS also advised stakeholders, businesses, and the general public to depend solely on official government communications for accurate, authoritative, and up-to-date tax information, warning that unverified reports could lead to unnecessary panic and misunderstanding.

The statement was formally signed by the Nigeria Revenue Service (NRS).