How to receive payments internationally in Africa

Heartbreaking as the Coronavirus pandemic was, it introduced a work upset that made the world considerably to a greater extent a worldwide town.

A huge number of experts, business visionaries, and consultants across the globe, including Africa, got to apply for and work with worldwide organizations and clients.

Regardless of the adjustment of the idea of work, Global payments are as yet a significant issue for some individuals in Africa. PayPal, for instance, is one of the greatest monetary innovation organizations on the planet, working with a huge number of dollars in exchanges consistently. However, in a few African nations like Nigeria and Zimbabwe, PayPal is fundamentally limited.

This isn’t perfect for African business visionaries looking for cash from their clients and clients. Indeed, even in nations like South Africa, Mauritius, Kenya, and so on, where PayPal is completely upheld, business people should have different payment frameworks for various purposes.

In this article, PulseNets has assembled a rundown of 4 unique ways African businesses can receive payments globally.

Payoneer

With an all out market capitalisation of over 2 billion USD, any reasonable person would agree that Payoneer is one of the biggest installment arrangement suppliers on the planet. Sent off in 2005 by Yuval Tal and settled in New York, US, Payoneer offers a few different cash represents getting installments around the world.

You should make a record with the organization and complete your KYC check, among different necessities. Thereafter, you’ll be given a USD and GBP ledger. Telecommuters can share these record subtleties with their clients/clients, who will pay for their administrations through the stage. As your record develops and your business develops, you’ll turn out to be bound to get sufficiently close to accounts in much more monetary standards, like the Canadian Dollar, among numerous others.

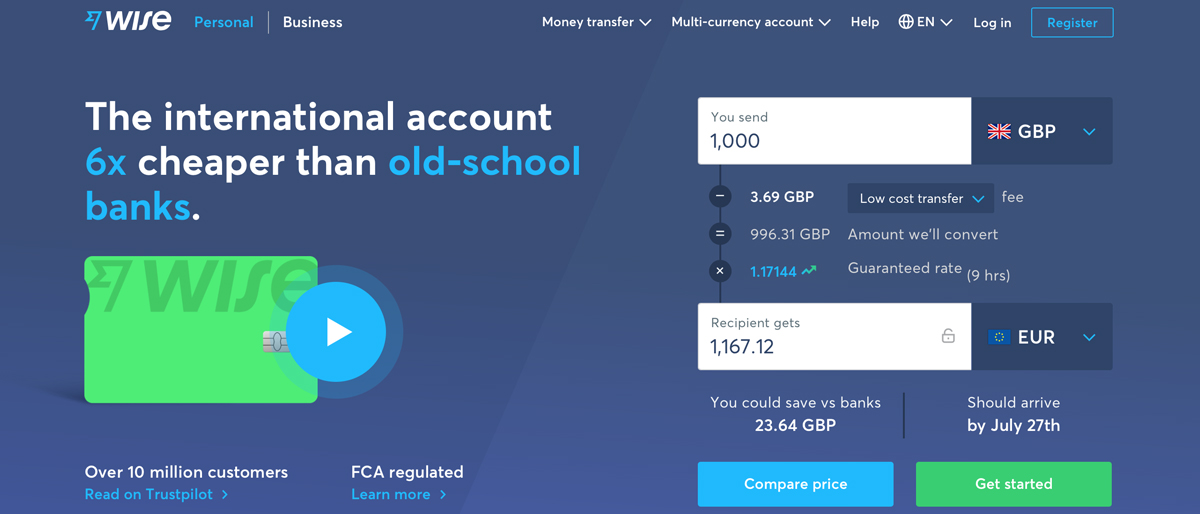

Wise

This business, which was formerly known as TransferWise, was established in 2010. Since then, it has gained the respect and business of more than 13 million individuals worldwide. It is a great way for African business owners to receive money. The procedure for creating an account is really easy and clear.

But it’s important to be aware that there can be certain limitations. For instance, you cannot receive money from Wise and have your Naira bank account instantly convert it to the local currency. You probably won’t be able to send Rands as you like in South Africa, but receiving is much simpler.

Having said that, this platform’s currency rate transparency is a great benefit. Even without creating an account, you may use the real-time calculator and converter on the landing page to examine the current exchange rates and estimate how much money you will receive in your home currency.

Grey

Grey is more recent and youthful in many aspects than the first two businesses on our list. Idorenyin Obong and Femi Aghedo, two Nigerians, formed it in 2020. Y Combinator is the startup’s supporter, and it has raised over $2 million in funding for growth.

Their approach to payment facilitation is the same as Payoneer’s. They open overseas accounts for their users and advised them that they were free to share the account information with their customers and receive payment as soon as they desired.

They have amassed more than 100,000 users during the past two years. The favourable conversion rates Grey offers when converting to local currencies are a big draw for many consumers. In Kenya and Nigeria, their services are currently guaranteed. The business intends to eventually expand, among other places, to Tanzania and Uganda.

Upwork Direct Contracts

Upwork is well-known to many independent contractors that provide digital services to clients all around the world. The platform has been around since 2013 and is used in more than 180 nations.

You may discover clients and charge them for your services using Upwork. The payment procedures are also simple; some nations permit the direct deposit of foreign cash into local bank accounts in their own national currencies.

Upwork previously opposed moving your projects off of their platform. However, you can obtain your client, build a contract on Upwork, deliver it to them, and have them pay you through Upwork thanks to the relatively recent Direct Contracts function. In essence, you’ll benefit from all of Upwork’s payment advantages. Additionally, you will be in total control as you choose the agreement’s terms, payment method, etc.

The main prerequisite is that the client cannot already have an Upwork account. If not, you are unable to submit them a contract and get payment.

Final Thought

Several African entrepreneurs confront a payment difficulty, which is something that many African businesses address. The list you just read just includes a few of them. It’s wise to do your own research to make sure the platform is appropriate for you before continuing.