PalmPay Customer Loses N2.8m to Fraudsters Because Agents Were Busy

Adetola Adewale Murisiku, an artisan resident in Lagos State, has narrated how the failure of PalmPay customer service agents to answer his calls cost him money to the tune of N2.8 million in May.

Murikisu said he had lost his mobile device on his way to work on that fateful day, May 20. Left with no means of communication and apprehensive about his financial safety, he attempted to reach PalmPay through their customer service lines to no avail.

According to him, all of PalmPay’s agents were suddenly busy when he tried reaching them.

“When I was sure I couldn’t find my phone, I thought of going to the Airtel office so I could retrieve my SIM and block access to my banks. I also immediately made an effort from my friend’s phone to call PalmPay customer service,” he said.

“But all of the lines we knew were somehow busy. The ones that picked said we could not get through to the agent; they told us the agent was busy.”

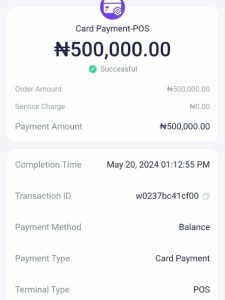

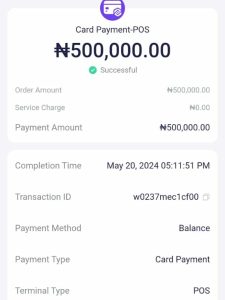

Receipt of the withdrawal from Murisiku’s mobile app

Receipt of the withdrawal from Murisiku’s mobile app

Receipt of the withdrawal from Murisiku’s mobile app

Murisiku would later attempt to access his accounts through his wife’s phone that evening. However, to his dismay, he found that all the money in his PalmPay account had been stolen. The transaction receipts reveal that the N2.8 million was withdrawn from his account in bits at a POS terminal.

“All the money in my account has been removed by these criminal elements. Plus, I saw that they linked an ATM card to my account. I don’t use an ATM card,” he said.

“They transferred the sum of N2.8 million from my account using an ATM card. Some of the PoS agents and accounts they transferred to are in the transaction history for proper investigation and verification.”

In his interview with FIJ, Murisiku insisted that he never linked any debit card to his account. He said that the transaction could only have happened due to a lapse or disregard for safety on the part of PalmPay.

“I didn’t link a card with my account. Before a card can be linked to an account, there must be a verification process like NIN or face verification, which was never done before linking a card to my account in my absence,” he added.

Murisiku thinks PalmPay should be held responsible for poor customer service, negligence and a breach of customer identity.

Also Read: Palmpay: PoS operators get July 7 deadline for CAC registration

FIJ contacted PalmPay for clarification through their complaints email on July 9. Barely 24 hours later, the email returned a strange error message.

Error Message from PalmPay’s customer complaints email.

Error Message from PalmPay’s customer complaints email.

FIJ sent the email again on July 10. FIJ also sent a text through PalmPay’s hotline. But no response has been provided as of press time. Meanwhile, in a follow-up conversation on July 10, Murisiku said that PalmPay contacted him via phone on that day and promised to investigate the removal.